Benefits of Having Insurance: We never know when disasters will strike, and the sudden occurrence of an accident or illness can leave us feeling vulnerable and financially drained. Thankfully, there’s insurance to provide us with much-needed protection. In this article, we’ll examine the main five advantages of having insurance and how to pick the right contractor.

Importance of Insurance

Protection is an essential instrument that gives monetary security and an inward feeling of harmony. With the right strategy, you can protect yourself, your family, and your property against startling misfortunes.

Overview of the Article

In this article, we’ll examine the advantages of having insurance, the various kinds of arrangements accessible, the variables to think about in picking the proper contract, and the moves to pick the right contractor.

Benefits of Having Insurance

Financial Protection

One of the essential advantages of having protection is monetary insurance. Insurance policies provide coverage for losses sustained during accidents, illnesses, or other unforeseen incidents.

Protection Against Financial Loss

Insurance coverage offers protection against financial loss by providing financial assistance to cover repair or replacement expenses.

Backup for Unexpected Expenses

Protection can likewise go about as a contingency plan for surprising costs, for example, rental costs, lodging bills, and travel costs, which can emerge during unexpected occasions like catastrophic events or mishaps.

Peace of Mind

With the right insurance contract, you can experience the harmony of psyche realizing that you and your family are safeguarded against startling misfortunes.

Reducing Anxiety and Stress

Insurance contracts can likewise decrease the uneasiness and stress brought about by unexpected occasions like mishaps, diseases, or cataclysmic events. At the point when you have the security of protection, you can have confidence that you are monetarily secure and can zero in on recuperating from the misfortune.

Preparedness for Emergencies

With the right insurance contract, you can be ready for crises and surprising occasions like cataclysmic events, loss of business, or startling sicknesses.

Legal Requirements Compliance

Insurance policies also help you comply with legal requirements. For example, auto insurance is mandatory in most states. Having the right insurance policy can prevent you from facing legal sanctions.

Meeting Legal Requirements

Having the right coverage can also help you meet legal requirements by providing the required amount of coverage.

Preventing Legal Sanctions

Insurance coverage can also prevent you from facing legal sanctions or penalties in case of loss or damage.

Future Savings

Some insurance contracts, like life and medical coverage, can likewise go about as long haul saving plans, giving you a safe monetary future.

Long-term Saving Plan

An extra security strategy can go about as a drawn out saving arrangement by offering monetary help as money esteem or other speculation open doors.

Securing Financial Future

A health insurance policy can provide financial support in case of unexpected health issues, thereby securing your financial future.

Access to Healthcare

One of the crucial benefits of having insurance is access to better healthcare services and coverage for healthcare expenses.

Coverage for Healthcare Expenses

Healthcare coverage strategies give inclusion to medical services costs, including hospitalization, analytic tests, and medical procedures, among others.

Access to Better Healthcare Services

By having insurance, you can access better healthcare services such as better hospitals, specialized doctors, and advanced medical technologies.

Types of Insurance Policies

There are different sorts of insurance contracts accessible on the lookout, including: Life coverage

Life Insurance

Life coverage gives inclusion to life chances, including passing, incapacity, or difficult diseases.

Types of Life Insurance Policies

There are two sorts of life coverage strategies:

Home Insurance

Home insurance provides coverage for properties and belongings against natural disasters, theft, and fire.

Types of Home Insurance Policies

There are various sorts of home insurance contracts, like danger protection, individual property protection, and responsibility protection.

Health Insurance

Healthcare coverage gives inclusion to medical services costs, including hospitalization, medical procedure, and doctor-prescribed drugs.

Types of Health Insurance Policies

There are various sorts of medical coverage strategies like individual health care coverage, family health care coverage, bunch health care coverage, and senior resident health care coverage.

Auto Insurance

Auto insurance provides coverage for accidents, theft, and other damages to the vehicle.

Types of Auto Insurance Policies

There are different kinds of accident coverage arrangements accessible, including exhaustive protection, crash protection, and obligation protection.

Travel Insurance

Travel insurance provides coverage for travel risks, including trip cancellation, medical emergencies, and lost baggage.

Types of Travel Insurance Policies

There are various kinds of movement insurance contracts, like clinical protection, trip-dropping protection, and crisis-clearing protection.

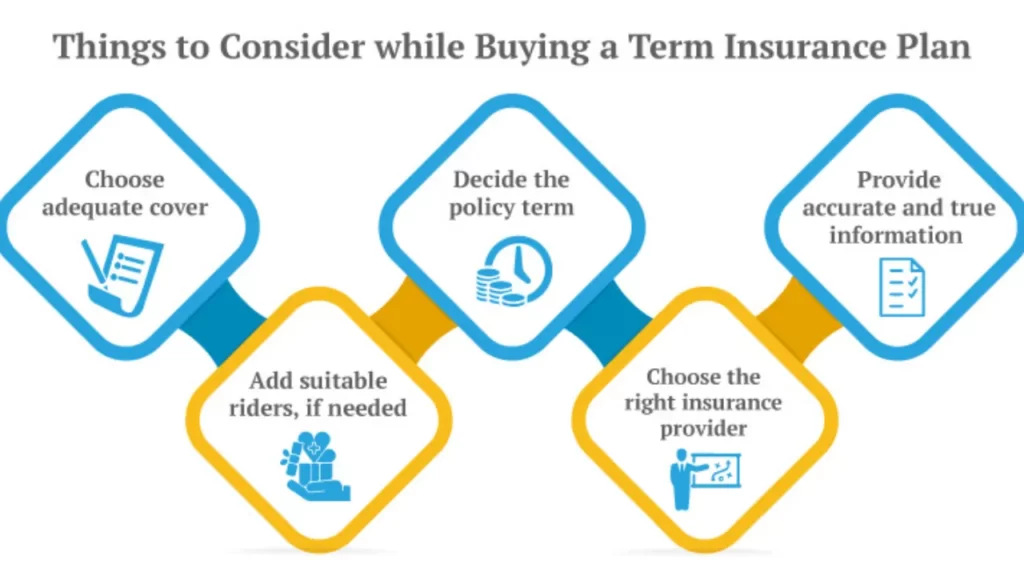

Factors to Consider in Choosing Insurance Policy

While picking an insurance contract, you want to think about the accompanying elements:

Inclusion

It’s important to determine your specific coverage needs and ensure that the policy provides adequate coverage.

Determining Specific Coverage Needs

You need to assess the risks and vulnerabilities of your life situation and determine the coverage needs accordingly.

Ensuring Adequate Coverage

It’s fundamental to guarantee that the inclusion is adequate to address your issues and that you’re not underinsured or overinsured.

Premium

The expense of insurance inclusion, known as the charge, relies upon the sort of contract and the degree of inclusion.

Evaluating the Benefits of the Premium Paid

You need to evaluate the benefits of the premium paid and ensure that the policy provides value for the money.

Deductible

Before the insurance contract kicks in, you want to pay a specific sum using cash on hand, known as the deductible.

Choosing the Right Deductible

It’s vital to pick the right deductible, contingent upon your monetary circumstance and the degree of chance you can endure.

Reputation of Insurance Provider

It’s critical to pick a legitimate protection supplier with a decent history in the protection business.

Reputation in the Insurance Industry

You need to investigate the reputation of the insurance provider in the industry, looking out for customer complaints and their resolution.

Customer Feedback

You also need to consider the feedback of other customers when choosing an insurance provider.

Financial Strength of Insurance Provider

It’s important to evaluate the financial strength of the insurance provider, considering their credit rating and financial reports.

Steps to Choose the Right Insurance Policy

When choosing the right insurance policy, you should follow these steps:

Identify Insurance Needs

Determine your specific coverage needs and assess the risks and vulnerabilities of your life situation.

Assessing Risks and Vulnerabilities

You need to assess the potential risks, such as loss or damage of property, accidents, or illnesses, and choose the required coverage accordingly.

Research Available Insurance Policies

Research and compare the available insurance policies from different providers, considering the terms and conditions, coverage, and premiums.

Comparing Policies from Different Providers

You should compare policies from at least three different providers to get the best deal possible.

Understanding the Terms and Conditions

It’s fundamental for read and comprehend the agreements of the approach prior to joining.

Consult Insurance Experts

Seek advice from an insurance agent or financial advisor when choosing the right policy.

Seeking Advice from an Insurance Agent

An insurance agent can provide valuable insights and recommendations on choosing the right policy.

Seeking Advice from a Financial Advisor

A financial advisor can also provide general insurance advice and help you make an informed decision.

Choose the Right Policy

Evaluate the policy that best fits your interests and budget and review the policy documents thoroughly before signing up.

Evaluating the Policy Fits Interests and Budget

Ensure that the policy you choose provides the coverage you need and fits within your budget.

Reviewing Policy Documents Thoroughly

Prior to joining, audit the arrangement archives completely, guaranteeing that the agreements are clear and justifiable.

Maintain Regular Communication with the Insurance Provider

It’s important to maintain regular communication with the insurance provider, updating your policy coverage as needed.

Maintaining Regular Communication with the Provider

You should keep track of your policy coverage and update it regularly to ensure that you have adequate coverage.

Updating Policy Coverage as Needed

You should also update your policy coverage as your life situation changes, such as buying a new house, getting married, or having a child.

Conclusion

In conclusion, insurance provides financial protection and peace of mind during unexpected events. Choosing the right insurance policy requires identifying your specific coverage needs, researching available policies, evaluating different factors, and seeking advice from insurance experts. With the right policy, you can secure your financial future and overcome unexpected losses.

FAQ:

Q.1 What is the best insurance policy for me?

The best insurance policy for you depends on your life situation and specific coverage needs.

Q.2 What coverage do I need?

Your coverage needs vary depending on the risks and vulnerabilities of your life situation and potential losses.

Q.3 How much premium should I pay?

The premium you should pay depends on the type of policy, the coverage needed, and your budget.

Q.4 What is a deductible?

A deductible is the amount paid out of pocket before insurance coverage starts.

Q.5 How do I choose a reputable insurance provider?

You can choose a reputable insurance provider by investigating its reputation in the insurance industry and customer feedback.

Q.6 How often should I update my insurance policy?

You should update your insurance policy when your life situation changes, such as purchasing a new house or getting married.

Q.7 What happens when I make a claim?

When you make a claim on your insurance policy, the insurance provider investigates the claim and pays out the covered amount, subject to the policy terms and conditions.